Contents:

Cash Flow StatementA Statement of Cash Flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business. For instance, oil exploration and production have the highest CapEx levels. Similarly, telecommunication, manufacturing, and utility industries also require substantial investments.

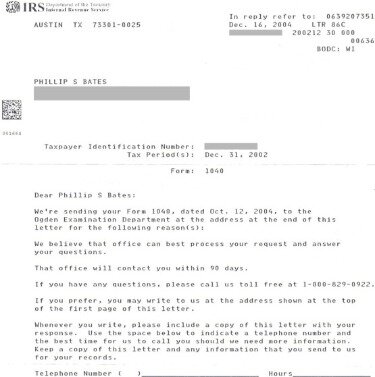

Form 497K Tidal Trust II – StreetInsider.com

Form 497K Tidal Trust II.

Posted: Fri, 21 Apr 2023 19:41:32 GMT [source]

Making capital expenditures on fixed assets can include repairing a roof , purchasing a piece of equipment, or building a new factory. This type of financial outlay is made by companies to increase the scope of their operations or add some future economic benefit to the operation. Operating expense is the expenditure done on the day to day basis for the regular functioning of the business, such as administrative expenses, general repair and maintenance, and utility expenses. In comparison, CAPEX is capitalized in the balance sheet as assets and allocated as expense over a period of its useful life. Higher level management approval is generally required for processing capex, which may not be essential in operating expense cases.

What Are the Primary Factors That Determine Capital Expenditures?

Some investors treat FCF as a “litmus test” and do not invest in companies that are losing money, i.e. have a negative FCF. The reverse of a capital expenditure is an operational expenditure, where the cost is incurred strictly for current operations. Examples of operational expenditures are administrative salaries, utilities expense, and office supplies. Since they are charged to expense in the period incurred, they are also known as period costs. The purchase of fixed assets (PP&E) such as a building — i.e. capital expenditures — is capitalized since these types of long-term assets can provide benefits for more than one year. Capital expenditures, also known as Capex, are investments in long-term assets such as property, plant, and equipment.

The purpose of capitalizing a cost is to match the timing of the benefits with the costs (i.e. the matching principle). Capitalizing is recording a cost under the belief that benefits can be derived over the long term, whereas expensing a cost implies the benefits are short-lived. The Capitalize vs Expense accounting treatment decision is determined by an item’s useful life assumption. Depreciation charged – $3,00,000Assume there is no other related transaction.

A talent pool is a database of job candidates who have the potential to meet an organization’s immediate and long-term needs. Capex and Opex describe the financial ramifications of building infrastructure on premises versus in the cloud. It is important to note that this is an industry-specific ratio and should only be compared to a ratio derived from another company that has similar CapEx requirements.

What is a Capital Expenditure?

Operating expenses include daily expenses like the cost of rent, office supplies, and staff wages that are part of running ongoing operations. The company had an existing capacity of 500 MT. However, the market demand for cement has grown significantly due to the country’s increasing infrastructure and real estate activities. Given the increased market demand, ABC Ltd. decided to set up a new production unit in the same vicinity as the existing unit. As a result, a new unit is expected to increase the production capacity by 300 MT. Free cash flow to the firm represents the amount of cash flow from operations available for distribution after certain expenses are paid.

In accounting, a capital expenditure is added to an asset account, thus increasing the asset’s basis . Capex is commonly found on the cash flow statement under “Investment in Plant, Property, and Equipment” or something similar in the Investing subsection. You can also calculate capital expenditures by using data from a company’s income statement and balance sheet. On the income statement, find the amount of depreciation expense recorded for the current period.

Expect Some U.S. Airlines To Announce Seat Configuration Changes In The Next Year – Forbes

Expect Some U.S. Airlines To Announce Seat Configuration Changes In The Next Year.

Posted: Wed, 19 Apr 2023 00:28:04 GMT [source]

Berry expanded its presence in areas outside of California beginning in 2003 as the company observed the opportunities to acquire natural gas and light oil to increase its portfolio. The new production unit set up by ABC Ltd. would increase its production capacity by 300 MT. Total Quality Management is a management framework based on the belief that an organization can build long-term success by …

What Is the Difference Between CapEx and OpEx?

It is based on the accounting equation that states that the sum of the total liabilities and the owner’s capital equals the total assets of the company. Positive Capex on a balance sheet indicates that money is coming into a company from sales of existing capital assets. Potential investors might see this as an indication that management lacks confidence in the future of the business. It can also be a sign that a company is not spending enough to maintain current operations and drive growth. Money spent repairing and maintaining existing equipment is not considered a capital expenditure.

- Vehicle purchase for delivery and distribution of goods is another capital expenditure that involves maintenance, repair, and depreciation charges.

- They are considered as long-term or long-living assets as the Company utilizes them for over a year.

- These are usually long-term assets that have a useful life or a productive purpose lasting longer than one accounting period.

Thinking of billing your advertising costs at the end of your yearlong cycle? Everything your company buys that is not a fixed asset falls under revenue expenditure, from new desk stationery to building maintenance. Revenue expenditures like those below are reported on the monthly revenue bill against that expense period’s (week/month/quarter) revenue. Calculate the increased amount of property, plant, and equipment by deducting the previous period’s total fixed assets from the current period’s aggregate. Since capital expenditures are a relatively expensive cost toward a long-term investment, they typically require higher-level approvals.

Operating expenses vs. capital expenditures

Certain expenses are made to diversify the business into new product lines and fields for multiple achievements. More information about the exact nature can be found from the company’s notes, located in financial filings. Intangible AssetsIntangible Assets are the identifiable assets which do not have a physical existence, i.e., you can’t touch them, like goodwill, patents, copyrights, & franchise etc. They are considered as long-term or long-living assets as the Company utilizes them for over a year. Purchase and installation of computers, laptops, and peripheral devices along with maintenance costs. ShareholdersA shareholder is an individual or an institution that owns one or more shares of stock in a public or a private corporation and, therefore, are the legal owners of the company.

Any expense that recurs consistently over a given time is a revenue expense. For example, any maintenance costs to a building owned by your company are revenue expenditures. Let’s explore the key differences between operating expenses and capital expenses so you can learn how they play a role in your business planning. As you’ll see, determining which expenses are operating expenses and which are capital expenses is not always clear cut. Let’s say ABC Company had $7.46 billion in capital expenditures for the fiscal year compared to XYZ Corporation, which purchased PP&E worth $1.25 billion for the same fiscal year.

Once approved, the bills for operating expenses are paid regularly, sometimes through an automated process. An operating expenditure is a daily cost required to keep the business operational. Acquisitions.These are new tangible and intangible assets, including real estate and patents. The acquisition of an existing business and the launching of a new one are considered acquisition Capex. If an item has a useful life of less than one year, it must be expensed on the income statement rather than capitalized, which means it isn’t considered CapEx. Capital expenses tend to require a large initial outlay of money or capital.

What is a Capital Expenditure (CAPEX)?

On the other hand, operating expenses can be deducted from the company’s taxes the same year they were incurred. The increase in the production capacity of the entity is not a basis for classifying the amount spent on setting up the production unit as capital expenditure. For example, if a company purchases a $1 million piece of equipment that has a useful life of 10 years, it could include $100,000 of depreciation expense each year for 10 years. This depreciation would reduce the company’s pre-tax income by $100,000 per year, thereby reducing their income taxes. A ratio greater than 1 could mean that the company’s operations are generating the cash needed to fund its asset acquisitions.

Tenants enjoy seamless keyless entry into their what does mm mean and can remotely open doors and gates for guests from anywhere in the world. GEP SMART is an AI-powered, cloud-native source-to-pay platform for direct and indirect procurement. The CapEx approvers also need to be able to take the company budget and future spending into account. If they need additional information and documentation, they must be able to notify the requester accordingly.

There is not an objective distinction between expensed costs and capitalized costs; each company determines for itself which costs should be capitalized vs. expensed . Most companies follow a rule that any purchase over a certain dollar amount counts as a capital expenditure, while anything less is an operating expense. Additionally, the IRS also views operating expenses differently from capital expenditures.

A company’s financial statements can be misleading if a cost is expensed as opposed to being capitalized, which is why management must disclose any changes to uphold transparency. The capitalized software costs are recognized similarly to certain intangible assets, as the costs are capitalized and amortized over their useful life. For example, your company purchases machinery worth $40,000 and the life of the asset is ten years. At the end of each accounting year, $4,000 is reflected by the depreciation expense in the financial statement. Forgot that maintenance costs aren’t factored into the capital expenditures on those new industrial printers? That’s a hole developing in your pocket all of a sudden—it’s a revenue expenditure.

Capitalizing indicates that the cost has been determined to be a capital expenditure and is accounted for on the balance sheet as an asset, with only the depreciation showing up on the income statement. Unlike operational expenses , capital expenditures are recorded — or capitalized — on balance sheets. This means that CapEx is not expensed on monthly or annual income statements. As a result, CapEx also isn’t factored in when calculating a property’s capitalization rate. For tax purposes, a capital expenditure must be depreciated over the useful life of the asset . A routine operating expense will be entirely deducted in the tax year it is incurred.

Examples of capital expenditure

Looking for training on the income statement, balance sheet, and statement of cash flows? At some point managers need to understand the statements and how you affect the numbers. Learn more about financial ratios and how they help you understand financial statements. The main difference is that they begin with purchase requests, ultimately leading to purchase orders. Since operational expenditures tend to be lower-value with more immediate urgency, they do not tend to have as lengthy of a review-and-approval process as capital expenditures. However, the OpEx approval workflow must move quickly if it is to keep up with the company’s daily activities and needs.

Capital expenditures involve larger monetary amounts that are too large to be expensed against a shorter revenue period. They were purchased because of their long-term benefits of growing a company or generating profit. Revenue expenditures are usually less expensive than capital expenditures, small enough to be expensed against a shorter revenue period. These small costs will be listed as expenses in the current accounting period and will be offset against revenue immediately. If Company A spends $1,000 per month on updates for a key piece of software used by each team member each month, then the $1,000 is a revenue expenditure in Company A’s monthly financial statement.

CIB Marine Bancshares, Inc. Announces First Quarter 2023 Results – Yahoo Finance

CIB Marine Bancshares, Inc. Announces First Quarter 2023 Results.

Posted: Fri, 21 Apr 2023 13:00:00 GMT [source]

Because of these challenges, the CapEx process tends to require a fairly intricate system of requests and approvals. Upon dividing CapEx by the useful life assumption, we arrive at $50k for the depreciation expense. Suppose a company purchased a building for $2 million, and the expected useful life is 40 years. One of GAAP’s primary goals is to match revenue with expenses, so recording the entire CapEx at once would skew financial results and result in inconsistencies.

From an income tax perspectives, businesses typically prefer OpEx to CapEx. For example, rather than buy laptops and computers outright for $800 apiece, a business may prefer to lease it from a vendor for $300 apiece for 3 years. So even though the company pays $800 upfront for the equipment, it can only deduct about $250 as an expense in that year. “Deducted” means subtracted from the revenue when calculating the profit/loss of the business.